Well, it happened. The House passed the Senate Fiscal Cliff ‘deal’ and now tax rates will go up on those making over $400,000 and spending cuts have been kicked down the road.

So how much tax revenue did this deal raise?

“The Senate bill would raise roughly $600 billion in new revenues over 10 years, according to various estimates.”

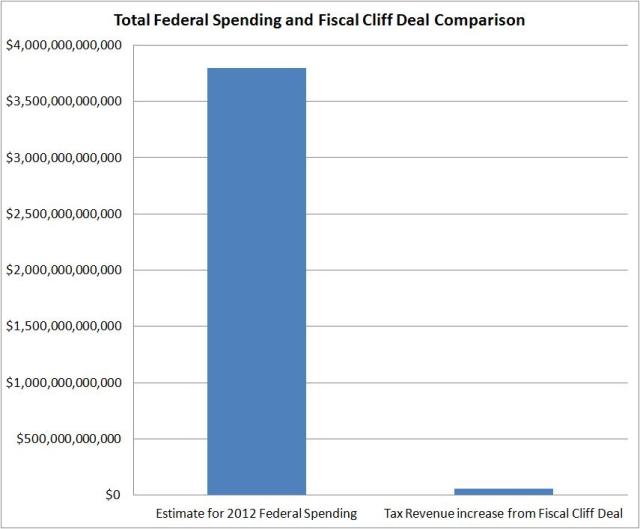

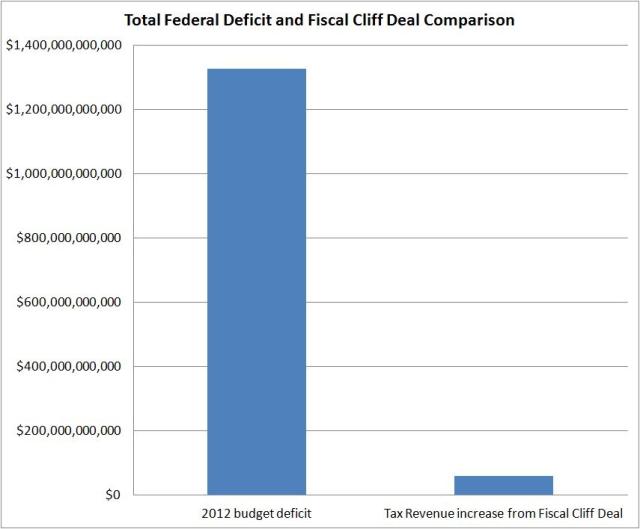

That’s $60 billion per year so let’s see how that increased revenue compares to the total Federal spending and Federal budget deficit. Using estimated 2012 Federal Government spending and deficit estimates, I created the following graphs.

You can see that this increased tax revenue is a mere drop in the bucket of our overall budget deficit (1.6% of total spending and 4.5% of our 2012 deficit).

I’ve said this before and I’ll say this again, WE HAVE A SPENDING PROBLEM, NOT A REVENUE PROBLEM!

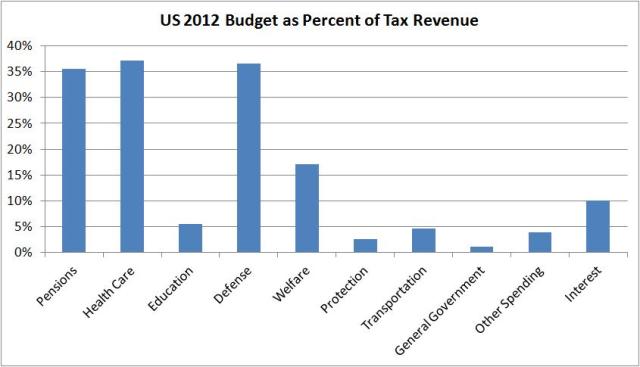

Here is a graph of the Federal Government outlay categories as a percent of our estimated 2012 tax revenues.

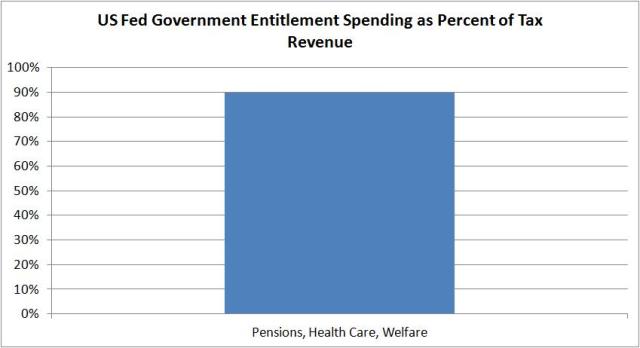

In case you don’t know, the “Pensions”, “Health Care” and “Welfare” line items are comprised of Social Security, Medicare, Medicaid, Unemployment Insurance, Welfare and Food Stamps. Now let’s see what percentage of US tax revenues is required to fund these entitlement programs.

That’s right, 90% of all the money the US government takes in from tax revenues goes to fund these programs.

Is that any way to run a country? 90% of all tax revenues will be redistributed to those who don’t work or pay taxes? If you were founding a new country, would this be the way you’d set it up? Of course not!

So we either raise taxes to get another $1.3 trillion to balance the budget or cut spending. I choose cutting spending but our Congressional leaders chose to raise taxes today. We should be revolting in the streets right now.

Might I suggest replacing some of the percentage charts with pie charts? It might be easier to process the info. Otherwise loved the article.

Outstanding summary of the facts but now the question is what to do about our spending problem?

There are 56 million people collecting Social Security today and that number is growing by 11,000 each and every day and will continue to do so for the next 15 years.

Add to that, Obama will add 30 million uninsured to Medicaid in 2014.

Even if you were to freeze Social Security payments, the cost of Social Security would grow by over 50% just with new seniors swelling their ranks.

You could raise the eligibility age to 70 but with a functional unemployment rate of over 10%, how would most of them who can not find work, find the money to live? (the vast majority of seniors do not have enough saved to live without social security and even if they do have savings, current interest rates are close to zero, forcing them to take greater risks investing their assets.)

There is also the explosion of obesity which has doubled the incidence of diabetes in the last 20 years with a corresponding increase in heart disease and strokes. Do we stop giving Medicare benefits to the elderly who have brought these lifestyle diseases on themselves? (over 90% of diabetes 2, heart disease and strokes are completely preventable with diet and exercise but it will cost trillions of dollars to treat people with these diseases over the next 20 years).

As the population ages, the incidence of Alzheimers and the costs for treatment and long term, 24-hour care is exploding . The only way to stem these costs is to find a cure or allow euthanasia. (Most people do not have long term care insurance and once they exhaust their assets, they become wards of the state.)

It’s easy to say we have a spending problem. That is self evident to anyone with a room temperature IQ.

The real question is in a Republic where we have reached a tipping point; where 47% of the population receives a check from the government, how do a majority of Representatives cut benefits and get reelected?

Great analysis and questions. I’ve taken a stab at attacking the Social Security and Welfare spending problems at the following links:

It comes down to people in my generation (in their 40’s) have to realize that we are the ones who will suffer to fix this spending issue. We’ll continue to pay for those older than us who are either on the system or were promised its safety net. We’ll have to plan accordingly (401k, etc.) and then our children won’t have to pay into a system that supports people in my generation.

We’re way past the time when solutions are painless. The pain will come and it will hurt.

This won’t end well.

No one has the spine (or, at least, those who DO don’t have sufficient numbers) to change our course. Thus, this’ll continue until it crashes, and then Blaine is 100% right in his questions: what’ll happen to those people?

Well, a lot of them are gonna be in a bunch of trouble.

A lot of them will die.

All you have to do is look at the UK right now: the Liverpool Care Pathway is exterminating their elderly, and it’s being described as “compassion”.

And Obamacare is far bigger, and far more complex, so that it will be capable of screwing things up FAR more quickly.

Big trouble is coming, kids. I’m as far from a conspiracy theorist as there is…

Heck, I’ve spent my career in insurance: life, health, Long Term Care, and property-&-casualty.

I don’t “do” conspiracy.

But there’s only one, logical way to interpret this whole mess.

To quote Clubber Lang from Rocky III:

“Pain”….

Pingback: Playing In The Margins | cosmoscon