I’ve said many times after the November 2016 elections that the only thing I wanted in 2017 from Trump and the Republican majority in the House and Senate was significant tax cuts.

I would prefer a radical change to our tax structure like those outlined in the Fair Tax proposals but I realize that something like that is a much too big ask in our hyper polarized political climate (although the Fair Tax could actually unite both sides…) so I’m glad with what has been proposed. At least a massive cut to the corporate tax rate would be enough for me to cheer!

And of course, the normal bloviating from the Left has come as a result of this with their tired “tax cuts for the rich” sound bites.

When the Left screams “tax cuts for the rich” this just tells me that they are either liars or they don’t really understand who actually pays the vast majority of US income taxes. For the politicians, it’s probably the former but for the average snow flake who probably has never filled out a tax form it’s probably the latter.

This website is a good place to help educate those who are truly ignorant about who actually pays most of the US taxes.

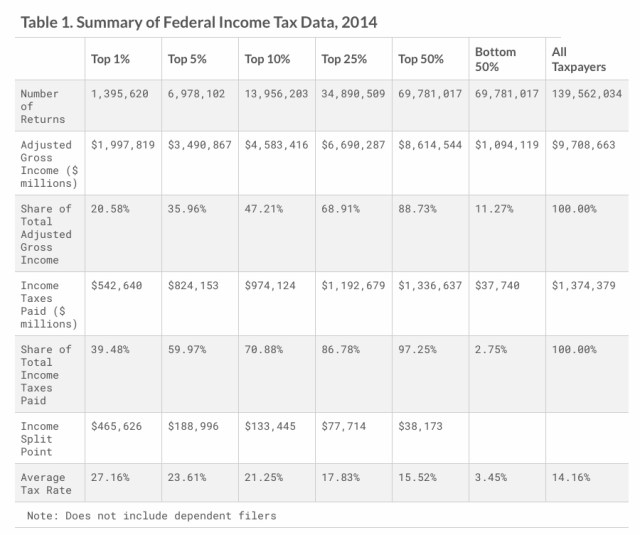

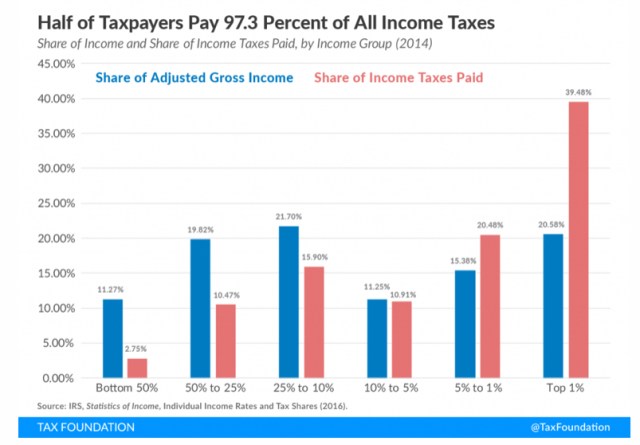

There are lots of charts and graphs on that link but these two should be all you need.

The top 1% of all income earners pays 40% of all income taxes but only account for 20% of all income.

The top 10% of all income earners pays 70% of all income taxes but only account for 47% of all income.

The top 25% of all income earners pay 86% of all income taxes!

If you’re going to give a tax break to folks you can only do that to the people that ACTUALLY PAY TAXES. That’s the top 25% folks!

And the top 25% includes folks who make over $77,000 per year. Hardly the mega wealthy here…

This isn’t some GOP trick to give massive tax breaks to the wealthy. It’s about math.

Excellent!

This morning I read about the ‘Tax System Explained in Beer’.

https://finance.townhall.com/columnists/danieljmitchell/2012/03/19/the-tax-system-explained-in-beer-n952039

I love that Beer story and thanks for reminding me of that!

The vilification of corporations really gets me miffed. Companies are in business to MAKE MONEY, and NOT to be a social experiment. And ANY understanding of basic economics has to include that ANY company passes along all costs of doing business (INCLUDING TAXES) to the end-user consumer. And, just in case someone’s education didn’t make this point clear: higher corporate taxes lead to a higher cost of goods and services, which ALSO puts a strain on the budgets of lower income families.

Sure, a company COULD take a reduction in taxes to increase profits, but in a fair and open market, you can be sure that others will use them to increase market share through more competitive services and pricing, as well as expanding operations an creating JOBS.

This whole “tax cut for the rich” and “evil corporation” group needs to remember one very unavoidable (and not meant to be “mean”) fact: People on welfare are NOT making up the majority of those who open businesses.