I stated in my previous post on Herman Cain’s 999 Plan analysis that one of the main arguments against the 999 plan was that it was not revenue neutral. That premise states that the tax collected from the 999 Plan would not be equivalent to the current tax collected with the convoluted tax code. I have done more research and have performed a calculation that will show this argument is not valid.

Remember that the 999 Plan will levy a 9% tax rate on each of the following: personal income (minus savings and charitable contributions), corporate profits and consumer purchases (through a national sales tax). For the rebuttal to the revenue neutral argument let me provide the supporting data to my analysis. The total tax revenues in 2010 were $2.163 trillion according to this link so that is the amount the 999 Plan must meet to be characterized as revenue neutral. The total personal income estimate came from here and is equivalent to $12.375 trillion. I estimated total annual corporate profits by taking the 3rd quarter of 2010 corporate profits ($1.659 trillion) and multiplying that by 4 to get an estimate of yearly profits by business ($6.636 trillion) (SEE UPDATE AT END OF POST FOR CLARIFICATION OF THIS ESTIMATE). Note: This corporate profit estimate should be conservative since corporate profits should increase as the economy recovers in 2013 (as Obama leaves and Federal regulations diminish which will allow the Free Market to flourish). The total consumer purchases come from the 2009 Census data on Annual Retail Trade Survey and amounts to $4.091 trillion.

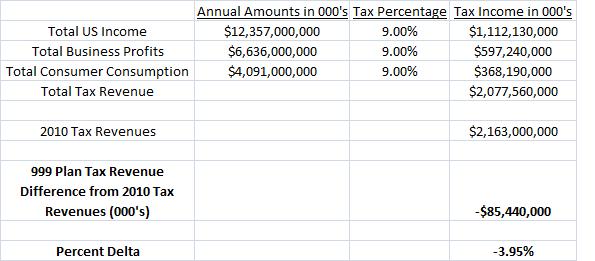

The high level analysis is shown in the table below. Using these conservative numbers, the 999 Plan misses the 2010 tax revenue totals by only 3.95%. This analysis is a static analysis and neglects economic improvements from consumers having more disposable income (consumer purchases increase) and corporations paying lower taxes (corporate profits increase). Once you take these net positive economic impacts into consideration, overcoming this delta should be trivial. Of course spending must be reduced since $2.163 trillion in tax revenue doesn’t cover the $3.456 trillion in Federal spending but having a Fiscally Conservative in the White House and a Fiscally Conservative leadership in both the House of Representatives and Senate will take care of that.

UPDATE – Herman Cain posted 9 rebuttals to common argumenst against the 999 Plan and you can find it here.

UPDATE – Arthur Laffer, famed economist, has also provided his supportive analysis of the 999 Plan here.

UPDATE 28-OCT-11 – Based on an error that was pointed out by a commenter (which I replied to here) I underestimated corporate profits. The real estimate for corporate profits should have been $1.659 trillion and not the higher $6.636 trillion I originally used. But I am going to keep my original value for corporate profits because, as I stated in the comments, Mr. Laffer used $9.5 trillion for corporate profit estimates from Cain’s team. I think the discrepancy comes in the fact that Cain’s plan would change the formula for calculating corporate profits that are taxed. Currently Cost of Goods Sold is subtracted from gross income and that includes labor and operating costs. In the brief description on Cain’s website corporations will only deduct purchases and capital equipment and that sounds like it excludes operating costs and labor. It could be that this will be taxed and therefore the higher figure is probably what we should use. It is my opinion that Cain’s staff needs to release the details on the Revenue Neutral analysis to clear up some of this confusion.

Pingback: Herman Cain Should Pivot to Politician | cosmoscon

Pingback: Perry Tax Plan Compared To Cain 9-9-9 Plan | cosmoscon

I. Regarding Corporate Profits, the article you reference clearly states, “American businesses earned profits at an annual rate of $1.659 trillion in the third quarter.” Whenever the term annual rate is employed, that means the amount has already been annualized. Since you took this amount and multiplied it by 4, you have grossly overstated the true amount. If you don’t believe it then show me when GDP was ever $19 trillion which is the result of your first two entries.

II. Regarding personal income, if you reference the BEA’s NIPA Tables which you refer to, you will find that the $12,357 trillion figure you reference only includes $7.9 trillion of wage and salary disbursements, $1 trillion of employer contributions to retirement plans and insurance on behalf of employees, $473 billion of employer contributions to government social insurance, $1 trillion of proprietors income, etc… How do you tax the employer’s share of social security when it no longer exists under your plan? Why would you tax retirement contributions and insurance payments made on behalf of employees? This is not technically income; it’s at best deferred compensation. Will it be taxed even though benefits won’t be received until far in the future? No. You need to subtract a big chuck from your figure.

Most egregiously it also contains $2.2 trillion of government transfer payments (i.e. social security, Medicare, Medicaid, Unemployment insurance, Veterans benefits, Welfare, Food Stamps and every other kind of government transfer payment). The implication is that your plan will tax items which are not currently taxed. How or why would you levy a 9% tax on welfare payments and food stamps? How or why would you tax Medicare and Medicaid? And why would you tax social security at 100%, when currently the most that is taxable is 50% to 85%, and that’s prior to taking a standard deduction and personal exemptions, such that most social security recipients don’t pay income taxes. So you need to subtract another $2.2 trillion here, unless this is your true intent.

III. Lastly under retail sales, if you examine what comprises the $4.091 trillion of sales you refer to, you will find that $389 billion is attributed to gasoline stations. So do you intend to add a 9% tax on top of the current amount of federal and state gasoline taxes? If so, that’s not a good idea. You will also find that another $68 billion, and probably more, is related to sales of used cars. There is no telling how many other items in this list are considered used goods versus new. You stated that used goods will not be subject to the national sales tax, and if that is indeed the case, a subtraction is needed for used items. Also $217 billion is attributed to Pharmacy store sales. So are you planning to levy a 9% national sales tax on medicine as well? That’s probably not a good idea.

When you say people don’t understand, because they haven’t looked at the analysis. I say what if they have and what if the analysis is flawed? Do you really intend on taxing seniors on social security, Medicare, and medicine? Will you be taxing welfare and food stamp recipients too? If not, then you need to make the appropriate adjustments to your analysis and admit that it doesn’t measure up.

If you are an honest man, which I believe you are, then you would take a closer look at this and make a fairer more reasonable assessment of this plan. I don’t know where your “delta” comes from, but just at a glance, you need to be subtracting a lot more than $85 billion from your projection. Just on the corporate profits mistake, your revenue is overstated by $448 billion. The government transfer payments portion of $2.2 trillion it means your revenue is overstated by another $198 billion, and that’s just the tip of the iceberg. Will you be taxing company paid insurance and retirement plan contributions as income as well? That would be to tax money that no one has physically received? I could go on and on, and I may in another venue, but this analysis is horribly flawed. Whoever came up with it did you a disservice.

http://www.bea.gov/iTable/index_nipa.cfm

Larry, If you are getting your stats from the Obama Czar Dept of Commerce BEA, as your link suggests, then I think that you are more naive than you are intelligent. Cain’s Bold 999 plan is not flawless, but it is a big step in the right direction as stated by Regan Economic Advisor Art Laffler and applauded by Paul Ryan. Definitely better than what we have now, or do you support the Cronyism and Tax loopholes?

Yes, and in the 1981 Act, Reagan cut the top rate from 70% to 50%, not to 9% with a national sales tax of 9%. He later raised the bottom rate from 0% to 15% and cut the top rate down to 28%. Reagan’s plan was reasonable, Cain’s proposition is extreme. In my humble opinion, the plan is extreme enough to fall off the other end of the curve. Laffer’s Curve had a sweet spot somewhere in the middle, while Cain’s plan overshoots the mark. I believe the 999-Plan will create a host of ‘unintended social problems’ that naturally occur on the other end of that curve. Giving $487,000 tax cuts to 95% of people making over $1 million per year, in this day and age, will solve nothing. I don’t even know what you call this, but it’s not conservative whatever it is.

If you follow his first link you’ll find that it links back to the BEA’s data. In my opinion he should have gotten all the data from the same source rather than trying to cherry pick data from different years, as if it’s not all available and up to date in the same periods. So does he overstate Corporate income by 4 times or not? Garbage in, garbage out. Use the right data and see how it comes out.

Thanks Larry Walker Jr. for taking the time to outline your concerns with my post here. Your comments are exactly why I started this website – to have online conversations about issues and improve my knowledge in all sorts of areas.

First, here’s a general comment. This is not my plan but Herman Cain’s plan. It is a plan I support but I am in no way affiliated with his campaign nor did his campaign have anything to do with this analysis. From your comments I was led to believe you were thinking you were talking to either Mr. Cain or someone affiliated with him. If I misunderstood then I apologize but I wanted to make this clear.

I hesitated in writing this post because proving revenue neutrality on a tax plan as revolutionary as this is very problematic and I restricted my analysis to a very high level. You are obviously more knowledgeable in this area and I am going to take time later to go through your comments and if I need to update this post I will gladly do so. My aim here is the truth – I have no agenda and want to make the right decision when I vote.

After a brief scan of your comments I do agree with you on my yearly corporate profit number so I’ll admit my method in obtaining this number was flawed. The amount paid by employers to government social insurance is also something I would agree with you about and with the Cain plan the roughly $500 billion will be eliminated so we can’t tax that. Both of these errors amount to around $500 billion in reduced tax revenue on this static analysis.

Did you follow the link at the bottom of the post to see Mr. Laffer’s analysis of the 9-9-9 Plan? Here we see $7.7 trillion used for income, $9.5 trillion for the business and $8.3 trillion for sales. Those numbers differ from mine on their individual components but when added together come close to my overall total. Odd that this WSJ article used $9.5 trillion for the corporate tax when you’ve shown (and I think I agree) the annual corporate profits are less than $2 trillion. There must be some other element I’m missing.

Again, doing this static analysis is a bit like predicting the weather a month away. There are too many moving pieces to the economy and I think we all underestimate the impact this tax plan will have on people’s motives and incentives. Businesses and people will have more money to spend in the Free Market and as the economy improves we’ll have more people with jobs which will lead to more tax revenue. Of course we’ll need to tackle entitlement spending and get to a balanced budget since working on the tax revenue without working on the government spending is ignoring our biggest problem.

Keep it simple, eliminate loopholes and let the markets determine winners and losers. I like the sound of that.

Thanks again for you time and comments and I’ll be sure to make any corrections to this post that I feel are in error.

My bad for thinking you were connected with Cain’s campaign. I was looking for the analysis he claims that people haven’t seen, and found your link on his North Star Writers Group rant, so at first I did think you were connected, until I later found you on twitter and looked at some of your other blog posts. Sorry to be so harsh, it was really meant for Mr. Cain.

Your final result is close to what Cain talks about, but I think he too will come up $500 – $600 billion short. Laffer probably adds wages back to corporate income thinking that because businesses won’t be able to deduct wages (for tax purposes) that taxable corporate income will be higher. However, that doesn’t mean that businesses won’t be paying out those wages, so there is really no net improvement to cash flow (7.65% vs. 9.0% on top of wages paid).

I think the other flaw with the 999 Plan is that not all wage paying entities are taxpayers. A large “chunk” of wage income is paid by the federal government, by state and local governments, and by other tax exempt organizations. And since neither of them file income tax returns, or are subject to federal income taxes, the policy of not allowing them to deduct wages will not subject them to a 9% income tax on the same. So government and not profit wages need to be backed out of the corporation number that even Laffer uses.

It’s not all that simple. Cain assumes that everyone works for a corporation and that everyone is paid wages, but that’s incorrect. There are sole proprietors, S-Corporations, Partnerships, non-profits, and governmental entities that don’t fit into his plan. If his plan were to be implemented, one of the dynamic revenue losses he would experience would be that small corporations like mine would simply dissolve, and become sole proprietorships or partnerships.

Anyhow, I’m focusing on other aspects of the plan. I think the macro-static implications are rather obvious, 35.0-15.3-35.0 vs. 9-9-9 doesn’t measure up no matter how you spin it.

See: http://larrymwalkerjr.blogspot.com/2011/10/obamas-9-9-9-tax-cut-for-blind.html

Larry Walker Jr., No problem and I didn’t take offense. As long as we stick to debating the issues and leave out the personal attacks I’m comfortable with confronting the brutal facts. I wouldn’t have started a blog if I couldn’t take criticism and read dissenting opinions!

I checked your website out and found that you are a tax advisor so my initial impression was correct that you are more knowledgable than I on this topic so I appreciate your comments.

I do think that moving to a Flat Tax system would work long term but like you said it’s more complicated than just waving your hand and passing a law. I hope that the momentum that Mr. Cain has started in this area can carry through 2012 and in 2013 we start researching this and come up with a new tax system that works better than the one we have now. Mr. Cain showed leadership and I think even he knows the details need to be worked out. It is unrealistic to think a presidential candidate can write a new tax law on his own and I think that is why he is staying on a high level on this plan.

I’ll follow you on Twitter and look forward to learning more from you on this subject.

“As long as we stick to debating the issues and leave out the personal attacks I’m comfortable with confronting the brutal facts. I wouldn’t have started a blog if I couldn’t take criticism and read dissenting opinions! ”

Agreed! You are a true patriot. And again, I apologize for my harsh tone.

Pingback: Liberal Motivations | cosmoscon

Pingback: Fair Tax Now! | cosmoscon